12 Hidden Profit Leaks Draining Your Business (And How to Fix Them Without Spending on Marketing)

- Shawn Degan

- Nov 25, 2025

- 5 min read

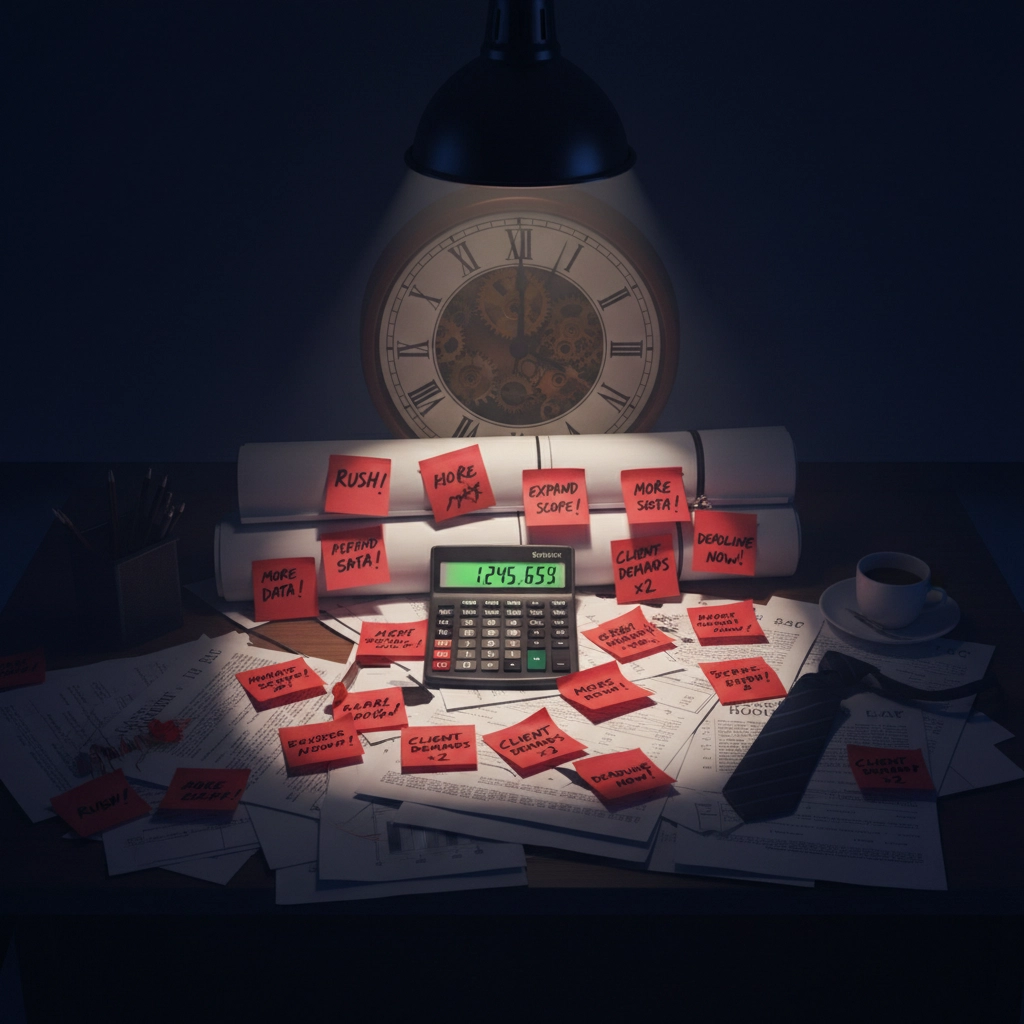

Let's get real for a minute. You're probably bleeding money right now and don't even know it.

The average business owner loses 15-20% of their potential profit to hidden leaks that have nothing to do with marketing, advertising, or customer acquisition. These aren't dramatic, obvious problems, they're the quiet killers that slowly drain your bottom line while you're focused on chasing new revenue.

Here's the thing: you don't need to spend another dime on marketing to plug these leaks. In fact, most of these fixes will put money back in your pocket immediately.

The Pricing Profit Killers

1. You're Undercharging (And Everyone Knows It)

If customers say "yes" to your prices immediately without any pushback, you're leaving money on the table. When was the last time someone questioned your pricing? If the answer is "never," you've got a problem.

Most business owners price based on what they think customers will pay, not what their service is actually worth. Big mistake.

The Fix: Raise your prices by 15-25% on your next three proposals. Track the response. You'll likely be shocked by how little resistance you get. One client of ours increased prices by 20% and lost exactly one customer out of 50. That's a net gain of 19% profit with almost zero effort.

2. Death by a Thousand Discounts

Every discount you give is profit walking out the door. "But discounts help me close deals!" Sure, and they also train your customers to expect them every time.

If you're discounting more than 10% of your sales, or if your discounts are bigger than 10%, you're hemorrhaging profit.

The Fix: Set a firm discount policy. Maximum 10% discount, maximum once per customer, and only for specific situations (like annual contracts or volume purchases). Better yet, raise your base prices and eliminate discounts entirely.

3. The Scope Creep Monster

"Oh, can you just add this one small thing?" Sound familiar? Scope creep is the silent killer of service-based businesses. Every "quick addition" or "small favor" adds up to massive profit loss.

The Fix: Create bulletproof project scopes and stick to them. Anything outside the original scope gets a separate quote. No exceptions. Yes, customers might push back initially, but they'll respect your boundaries and your profits will thank you.

The Billing and Revenue Recognition Disasters

4. Time Worked, Money Lost

Are you tracking every billable minute? If not, you're probably losing 10-30% of potential revenue. This is especially brutal for service businesses where time literally equals money.

The Fix: Implement strict time tracking for all billable work. Use tools like Toggl or Clockify, and make tracking mandatory. Review utilization weekly. If you're not billing for at least 70% of your work time, you've got a leak.

5. Billing Errors and Invoice Mistakes

Manual billing processes are profit killers. Typos, calculation errors, and forgotten invoices add up fast. One missed invoice per month could cost you thousands annually.

The Fix: Automate your billing process. Use software that pulls rates from a central database, calculates totals automatically, and sends invoices on schedule. Have someone review all invoices before they go out.

6. Pricing Structure Confusion

When your team doesn't know your current pricing, they'll inevitably undercharge. This is especially common in businesses with multiple service offerings or complex pricing tiers.

The Fix: Create one master pricing document that everyone can access. Update it immediately when prices change. Train your team quarterly on current rates. Audit actual charges against your pricing monthly to catch discrepancies.

The Operational Efficiency Nightmares

7. Manual Processes Eating Your Profits

If you're still doing manually what could be automated, you're burning cash. That customer onboarding process that takes 45 minutes? It could probably take 10 minutes with the right tools.

The Fix: Map out your entire customer journey and identify bottlenecks. Look for repetitive tasks, data entry, scheduling, and communication that can be automated. Even simple automation tools can save hours per week.

8. Overhead Costs Gone Wild

Subscriptions multiply like rabbits. Software tools accumulate. Before you know it, you're paying for five different project management tools and three accounting platforms.

The Fix: Audit all your recurring expenses monthly. Cancel anything you haven't used in 30 days. Negotiate annual contracts for better rates on tools you actually use. Set one person responsible for monitoring overhead.

9. Payroll Inefficiencies

Your payroll is probably your biggest expense, and it might also be your biggest leak. Paying for unproductive time, inefficient workflows, and unnecessary overtime adds up fast.

The Fix: Track productive hours versus paid hours for each team member. Identify low-productivity patterns and address them through training or process improvements. Use project management tools to optimize task allocation.

10. Fixed Costs vs. Revenue Mismatch

When your fixed costs are too high for your current revenue level, every sale has to work overtime just to break even. This is a profit killer that many business owners ignore.

The Fix: Calculate your exact break-even point: the revenue needed to cover all fixed costs. Make sure your monthly revenue consistently exceeds this by at least 50%. If not, either increase sales or reduce fixed commitments.

The Customer and Financial Tracking Failures

11. Unprofitable Customers Draining Resources

Not all customers are created equal. Some customers cost more to serve than they're worth. High-maintenance clients, constant hagglers, and small-ticket buyers can destroy your profitability.

The Fix: Calculate the true cost of serving each customer (including time, resources, and hassle factor). Identify your unprofitable customers and either raise their rates or part ways. Focus your retention efforts on profitable customers only.

12. Flying Blind Without Gross Profit Tracking

If you don't know your gross profit margin, you can't optimize it. Many business owners focus on top-line revenue while ignoring the cost of delivering that revenue.

The Fix: Calculate your gross profit margin monthly (revenue minus direct costs of goods/services sold). Set a target of at least 50% for service businesses. Track trends to catch cost increases before they become major problems.

Your Profit Leak Action Plan

Start with the biggest impact items first:

Audit your pricing - This alone often reveals $25,000+ in annual opportunities

Track your gross profit margin - You can't improve what you don't measure

Eliminate unprofitable customers - Sometimes subtraction is more powerful than addition

Automate your most time-consuming processes - Buy back your time and reduce errors

The beautiful thing about profit leak fixes? They don't require marketing budgets, advertising spend, or customer acquisition costs. These are internal optimizations that improve your bottom line immediately.

Most business owners are so focused on bringing in new revenue that they ignore the money already flowing through their business. But here's the reality: fixing profit leaks is often easier and more profitable than acquiring new customers.

Pick three leaks from this list that hit close to home. Implement fixes over the next 30 days. Track your results. You might be surprised by how much profit was hiding in plain sight.

Ready to stop the bleeding and start keeping more of what you earn? The fixes are simpler than you think, and your future self will thank you for taking action today.

Comments